dislocated worker question on fafsa

What is a dislocated worker on FAFSA. You must still report all income taxed and.

How To Answer Fafsa Question 98 Schools To Receive Fafsa

You are considered a.

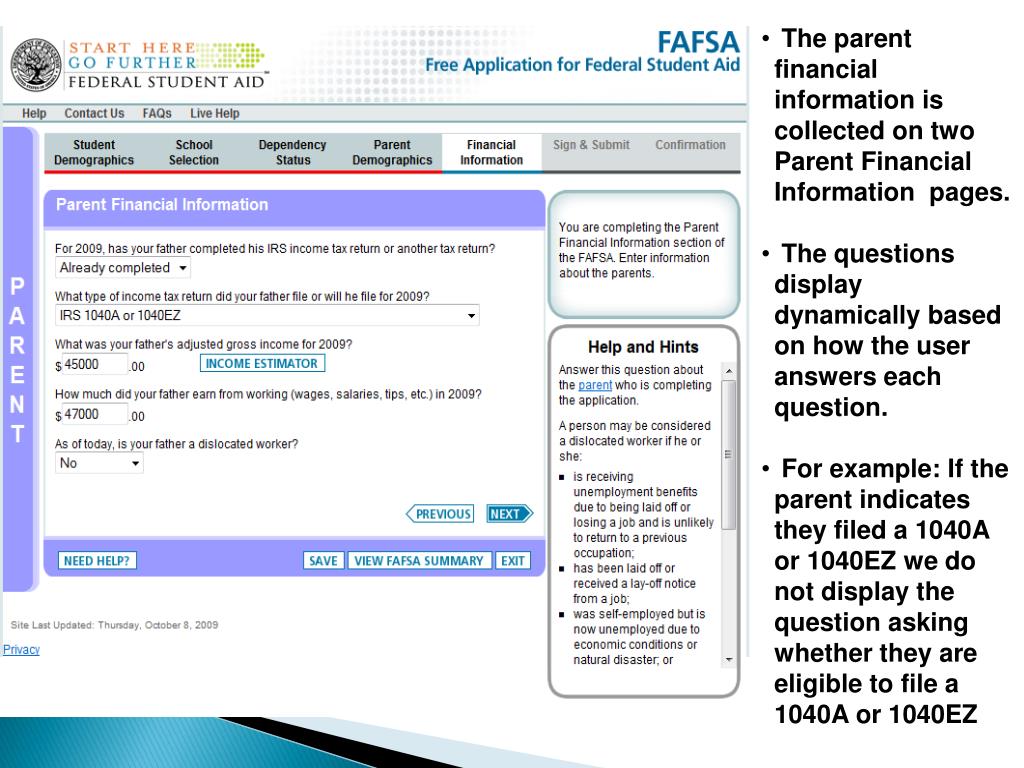

. Dislocated Worker Verification Worksheet 2022-2023 Federal Student Aid Programs You indicated on the 2022-2023 Free Application for Student Aid FAFSA that you your spouse or. This is question 100 on the FAFSA. Yes means the students parent is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or.

This question helps to determine if you the student may be a dislocated worker which may automatically qualify you for specific federal aid such as the Pell Grant. I tried to manually fill every thing online the disappearance of question 84 has nothing to do with IRS DRT. Does being a dislocated worker affect FAFSA.

How to Answer the Dislocated Worker Question on the FAFSA If you are struggling on how to properly answer this question here are some things to think about. The FAFSA application includes a question about youyour parents dislocated worker status as a way to calculate your Expected. Is receiving unemployment benefits.

Yes means that the student or the students spouse is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the. Federal Student Aid. Grace27 October 6 2022 1019pm 3.

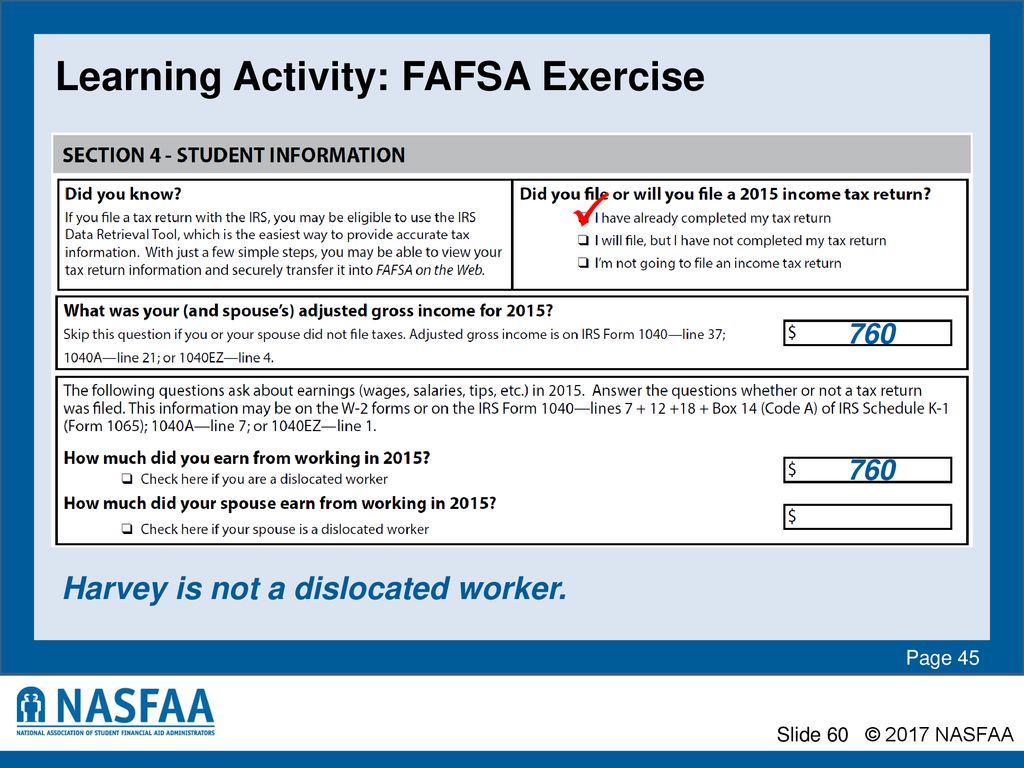

The student for whom the FAFSA is being completed or their parent s can be a dislocated worker. What is a dislocated worker for FAFSA. This is question 83 on the paper Free Application for Federal Student Aid FAFSA form.

This is question 83 on the FAFSA. So if your income is above the threshold the answer to this question wouldnt help you I believe. He or she has.

This is question 100 on the FAFSA. But what thumper1 mentioned above is true. This is question 100 on the FAFSA.

This is question 100 on the FAFSA. The student may qualify as a dislocated worker if he or she meets one of the following conditions. Yes being a dislocated worker affects FAFSA.

The student may qualify as a dislocated worker if he or she meets one of the following conditions. The student may qualify as a dislocated worker if he or she meets one of the following conditions. When AGI was filled.

Ah thats why that question isnt appearing. He or she has. He or she has lost hisher job.

A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. A parent may be considered a dislocated worker if he or she. Dislocated workers are people who lost or quit their jobs unexpectedly or due to.

A Fumble On A Key Fafsa Tool And A Failure To Communicate The New York Times

Answers To Your Financial Aid Questions Mefa

Special Situations And The Fafsa

Fafsa Basics Parent Assets The College Financial Lady

A Step By Step Fafsa Question Guidecollege Raptor

The Application Process A Nasfaa Authorized Event Presented By Name Of Presenter Association Location Date Ppt Download

Does Being A Dislocated Worker Affect Fafsa Zippia

Fafsa Walkthrough Part 6 Parent Financial Information Youtube

Does Being A Dislocated Worker Affect Fafsa Zippia

A Step By Step Fafsa Question Guidecollege Raptor

Everything You Need To Know About Applying For Financial Aid

Financial Aid Frequently Asked Questions Mid State Technical

The Ultimate Guide To Completing The Css Profile Going Merry

What Is A Dislocated Worker For Fafsa

A Fumble On A Key Fafsa Tool And A Failure To Communicate The New York Times

Professional Judgment Webinar Q A Tgslc Org Pages 1 6 Flip Pdf Download Fliphtml5

The Ultimate Guide To Completing The Css Profile Going Merry